How To Set Up A Budget Binder

This site contains affiliate links to products. Nosotros may receive a committee for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases . Read our disclaimers folio for more information.

Allow me ask you something- what are your money goals?

When you think about your finances, what'south the number one thing you desire to feel expert nearly?

Do you want to exhale a sigh of relief because you have a monthly budget that works for you?

Do you lot want to be free from monthly credit card payments, and go debt-free?

Do you desire to make a savings program that y'all feel confident about?

I've got skillful news for you, friend- not only tin can you do this, just y'all can do information technology easily- all from the comfort of your domicile.

Alllll of your financial goals can be achieved while sitting in your PJs.

I know it's possible because I've done it myself- with a pen and paper (and a picayune ambition), I went from:

-No savings to over $x,000 in a savings account

–$35,000 in debt to $17,000 in debt (and hopefully soon NO debt ;))

Ofttimes, the biggest thing standing between you and your money goals is a plan. More than importantly, a solid plan with goals that yous WANT to achieve!

Once I had my plan written down in forepart of me, I knew what I wanted to do and how badly I wanted to get there.

Ask yourself- what exercise yous actually want to reach? Imagine yourself with no debt, or with coin put away for a rainy day. Once you know what is motivating you lot, the planning part is easy.

And to go far easier yet, I put together a consummate budget binder system that you can print off at dwelling house!

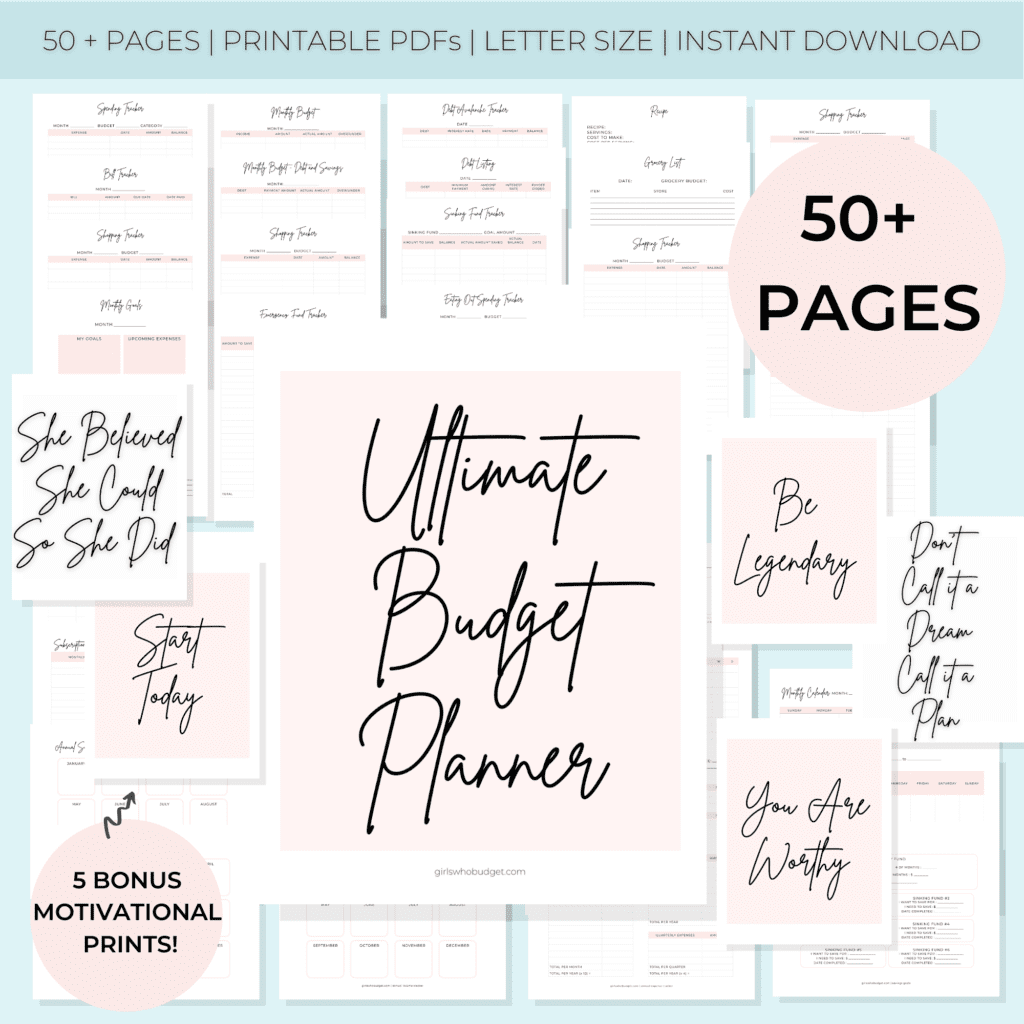

The Ultimate Upkeep Planner is a consummate money planning guide- it'due south over 50 budget printables that tin can be printed off at domicile (or at your local print shop if you don't accept a printer). Put them in your favourite binder, add some dividers if you want to, and you have a budget binder system that's ready to get!

Information technology's crazy like shooting fish in a barrel, and information technology helps that the pages are super beautiful, also 🙂

P.South.– there is also a black and white version (no colour ink required) that y'all can bank check out here!

P.P.S.– this is the exact binder arrangement I utilise! As someone who has had to work through creating a upkeep, paying off debt, and learning how to save money, this is something I really put a lot of middle into.

So how do you become started with a budget binder?

Let's walk through it, step-by-footstep- I'thou so excited for yous to tackle your goals!!

What is a budget binder?

You've probably heard of people using budget binders or budget planners at dwelling, but y'all might not know what it is they're talking near.

A budget binder is a parcel of printable PDF pages- you download them to your computer, hit save, and you have access to the files for life. Y'all can impress off as many copies as you similar.

Why should I use one?

Many of u.s.a. have experienced money struggles or just felt similar nosotros needed a real programme for our coin.

I love using a upkeep binder because:

-It's like shooting fish in a barrel- I can download the files to my calculator and start printing off the pages I want

-Information technology'south super customizable- I can impress off only the pages I need

-It'due south really affordable- you lot will need a binder, a pigsty punch, and access to a printer. That'southward it! Dividers and highlighters are a nice addition, too, only not required 😉

How to become yours:

But visit our Etsy shop, click Add To Basket, and then complete the bank check out process. As shortly as you're washed, your printables will exist prepare for download under "Purchases and Reviews" on your Etsy account.

What pages should I use?

I'll be showing you the pages that anybody should start with- after that, you tin pick and choose from the remaining pages based on your unique goals, like saving money or paying off debt.

And if these goals always change- you can simply print off new pages!

When should I start?

Right away!

To avert any defoliation, showtime to plan for the upcoming calendar month. That manner you can start the side by side calendar month on a clean slate.

How exercise I fix my budget folder?

Although you lot could only print off the pages on their ain, you tin can feel extra organized by putting your pages in a folder.

In one case the pages you want to use are ready to go, simply hole punch and insert in your binder.

Here is what you'll need:

–Binder (notation: all pages are US Letter size [8.5" x eleven"], and then proceed this in heed when selecting a binder)

–Hole punch

Optional:

–A printer and paper at dwelling (you can also visit your local print shop)

–Dividers

–Highlighters

–Stickers

Allow's swoop into the fun office, at present- pulsate coil, delight!

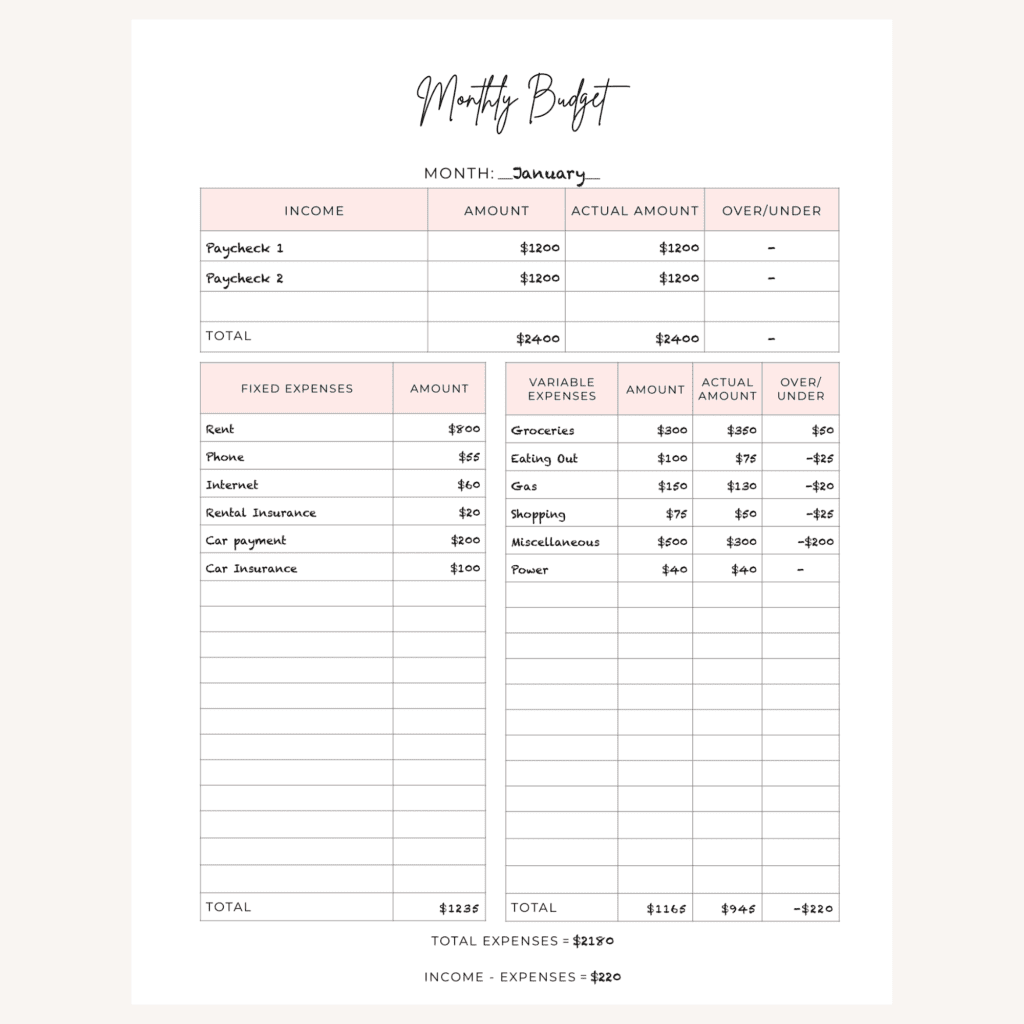

Monthly Upkeep

A monthly budget is essential to whatsoever money plan. Before you tin can get-go on any other goals, you lot need to empathise what money is coming in, and where exactly that money is going.

This allows y'all to determine if your money is existence over or nether spent in certain places.

Information technology'due south also the offset pace in feeling confident about how you're spending your money.

Income: Begin past writing down your income for the month, which is how much money y'all expect to make.

Expenses: Stride 2 involves seeing where you want to spend the coin yous're making- how much of it do you want to go towards bills, groceries, debt repayments, or savings?

Get-go with your fixed expenses, which are the ones that are the same every month. Some examples of this are your internet bill, phone beak, and rent.

Now let's tackle your variable expenses, which are the ones that can vary month to month (call back of groceries, gas coin, or a ability bill that varies based on usage).

Take some fourth dimension to think of how much you want to spend on these categories (maybe with extra money leftover for savings or extra debt payments). Check your online cyberbanking history if you're not sure how much you typically spend.

Note: you tin can put savings and debt repayments in this cavalcade, but there is also an optional 2d page that gives you more than room to list these amounts.

Put these numbers in the Corporeality column. Then in one case the calendar month is over, you tin can update the Bodily Amount cavalcade with how much yous really spent.

If you lot go over budget on something the first month or two, don't sweat it! It can take fourth dimension to nail down how much y'all really spend in an average month.

Once yous're done filling in your income and expenses, total each category upwards, and subtract expenses from your income (Income – Expenses = Leftover Corporeality).

You have 2 options hither! The first is to leave the budget as information technology is, and use the leftover money as you lot encounter fit during the month.

The adjacent option is to put this corporeality in your Variable Expenses as Miscellaneous spending for the calendar month (my personal preference), or by putting it towards other expenses.

The pick is yours, as long as yous don't have a Leftover Amount that is negative (ie. your expenses are more than than your income!). If you brand a budget and find that you lot're in this situation, information technology's time to reduce your expense, so that you lot are living within your means.

Of class another option here is to expect at increasing your income, just this tin can be a lot harder to control.

At the end of the month, pull out this page once again and fill in the bodily amounts for the month.

Then, start a fresh new folio for the new month!

Feel gratuitous to play around with the numbers until you are happy with them- and don't await to take the "perfect" budget the showtime time around, or even the first few times. Your budget will never be perfect, and information technology will modify over time.

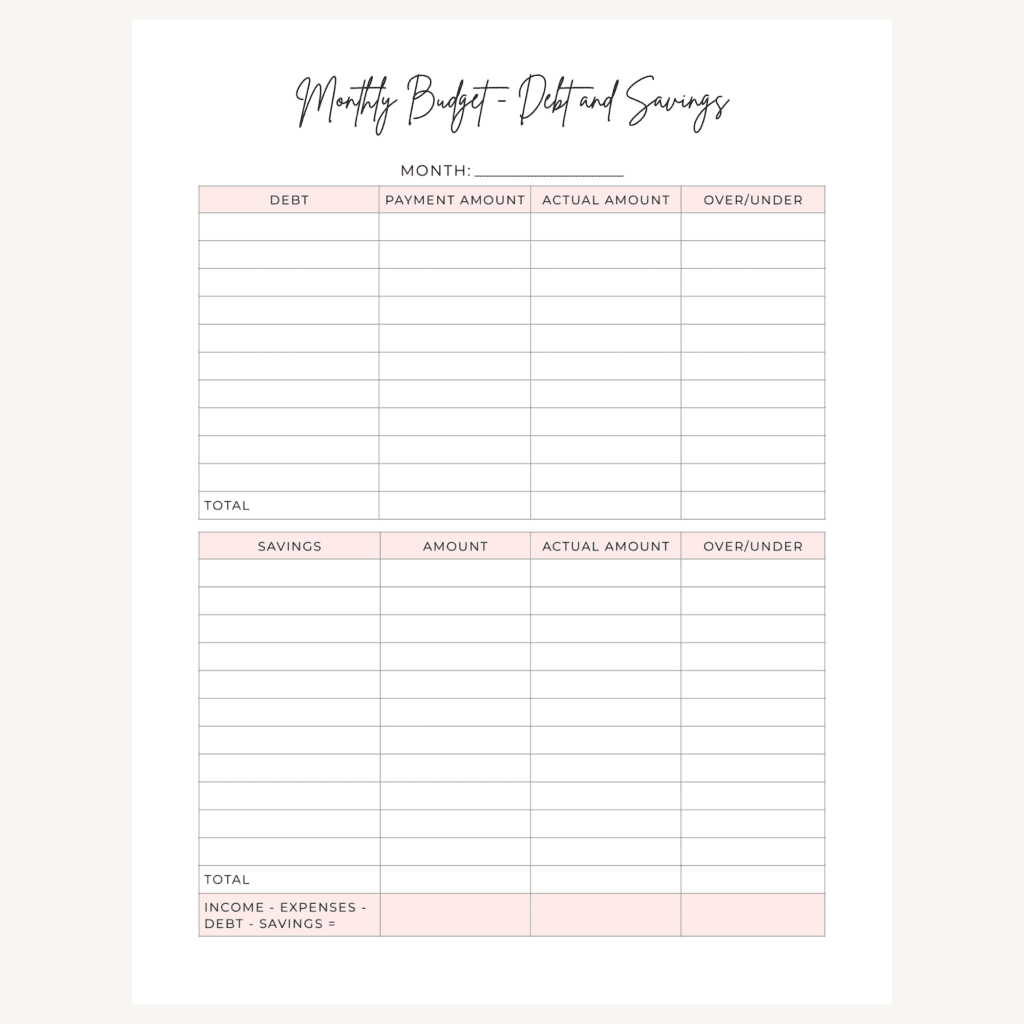

Optional: Use a separate page for your debt payments and savings contributions.

Although this is not necessary, it is my preferred method of budgeting. If your goals are focused on either of these things, y'all may want to consider it, too.

I like looking at how much I am spending on paying off my debt, every bit well every bit how much I am putting in my savings. The reason for this is elementary- I desire to become rid of the debt payments and plow them into more savings each calendar month!

Then if I see that I'm spending $500 on paying off my student loans, I know that once that loan is paid off, I will have $500 actress every month that I can put straight in my savings!

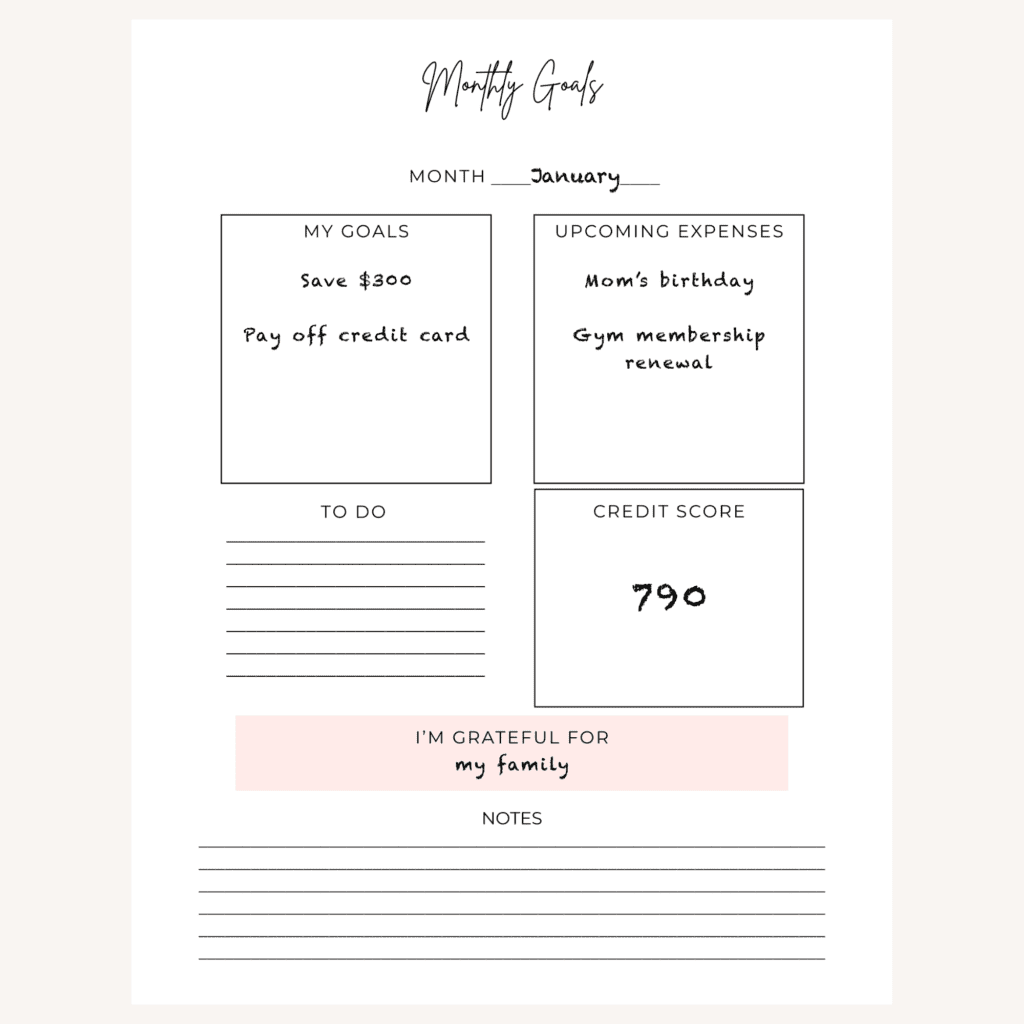

Monthly Goals

Two key parts of your budget volition exist motivation and accountability. This Monthly Goals folio checks off both of these boxes for you.

Commencement the month by reminding yourself of your goals (why are you doing this?). These can be long-term or brusque-term goals.

Plan for whatever upcoming expenses for that month, like a birthday or a vacation. You will be prepared to spend a petty extra on these things and tin can program for them.

What would you lot like to go done in the next 30 days? Practise you demand to cancel a subscription, meet with your financial advisor, or even make a dentist appointment? Brand sure you get everything done by putting them in the To Do section.

Check your credit score and write it down. Don't be concerned by minor fluctuations in this number from month to month, just information technology is good to be aware of it.

Call back of one thing you are grateful for this month, fifty-fifty if it'south simply that you lot are able to make the minimum payments on a credit carte.

Monthly Agenda

I don't know most you, but I'm a visual person. If I have a place to encounter when payday and bill days are, it makes me feel and then much more organized.

Feel free to utilise this calendar each calendar month for any important dates. Yous tin can get creative and add some stickers, too.

Bill Reminder Canvass

Ane of the best feelings is knowing that y'all are ON TOP of your bills, all of the time. You're never wondering if you paid your phone bill this month, or if you're late on information technology this time.

This is one of my favourite pages for this reason! It's so easy to use, too.

List your recurring monthly bills, and when you pay information technology, check off the corresponding monthly box. At the cease of every month, check in and make certain you didn't miss any. Then easy so helpful!

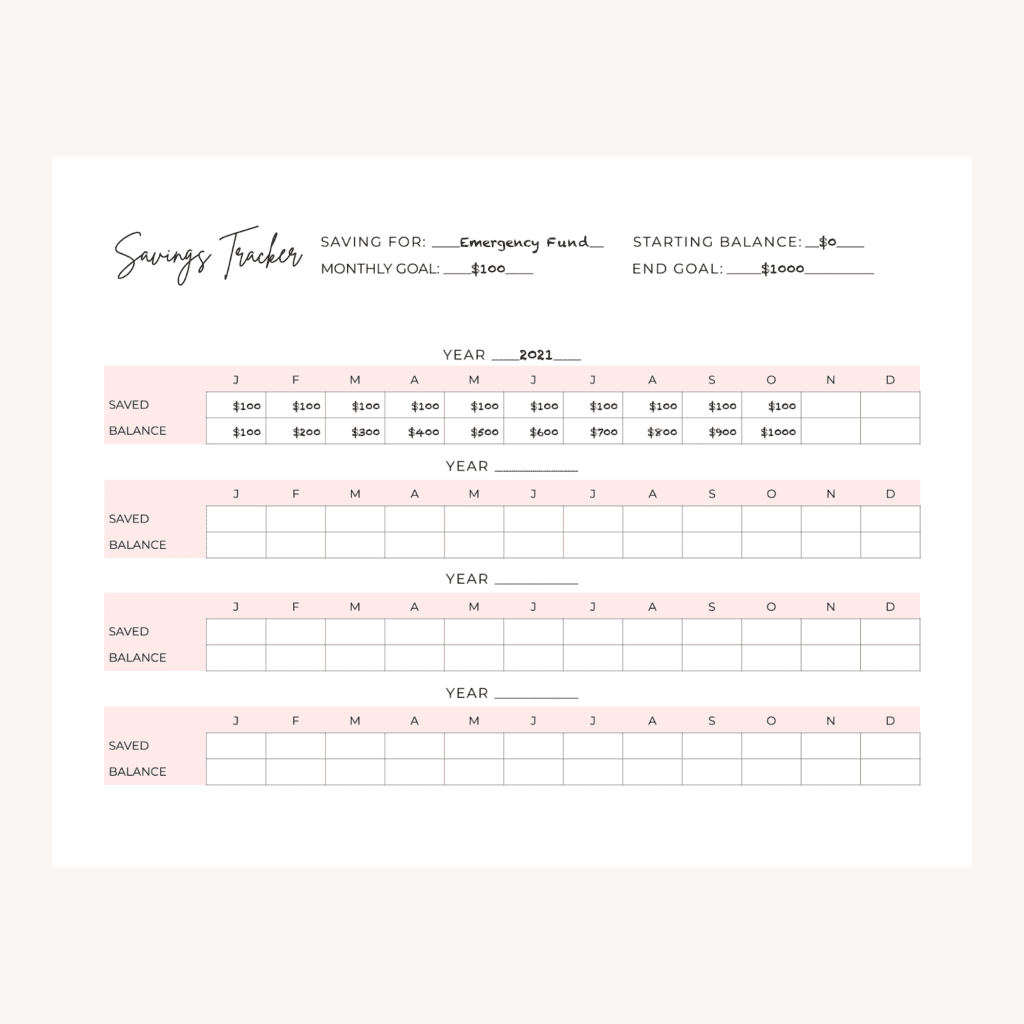

Savings Tracker

Dorsum to me beingness a visual person- this savings tracker makes saving money very visually highly-seasoned.

Saving coin sounds similar a good thought, just it can be deadening- why put coin in your savings business relationship when you could purchase literally anything else in the world with that money?

I get it.

In order to save coin, you demand to know exactly why you want to relieve information technology- you lot need to exist motivated to salvage information technology instead of spending it on something else.

And then ask yourself, what are you saving for? What is your starting residuum (have y'all already saved money for this)?

Write downwards how much y'all want to salvage for this every month, and how much coin yous desire to have saved at the stop.

Make full in the tracker with the monthly amount every calendar month, followed past what your balance will be every fourth dimension you salve more.

I too like to fill each foursquare in with a highlighter when I'm done, so I can see the progress I'm making.

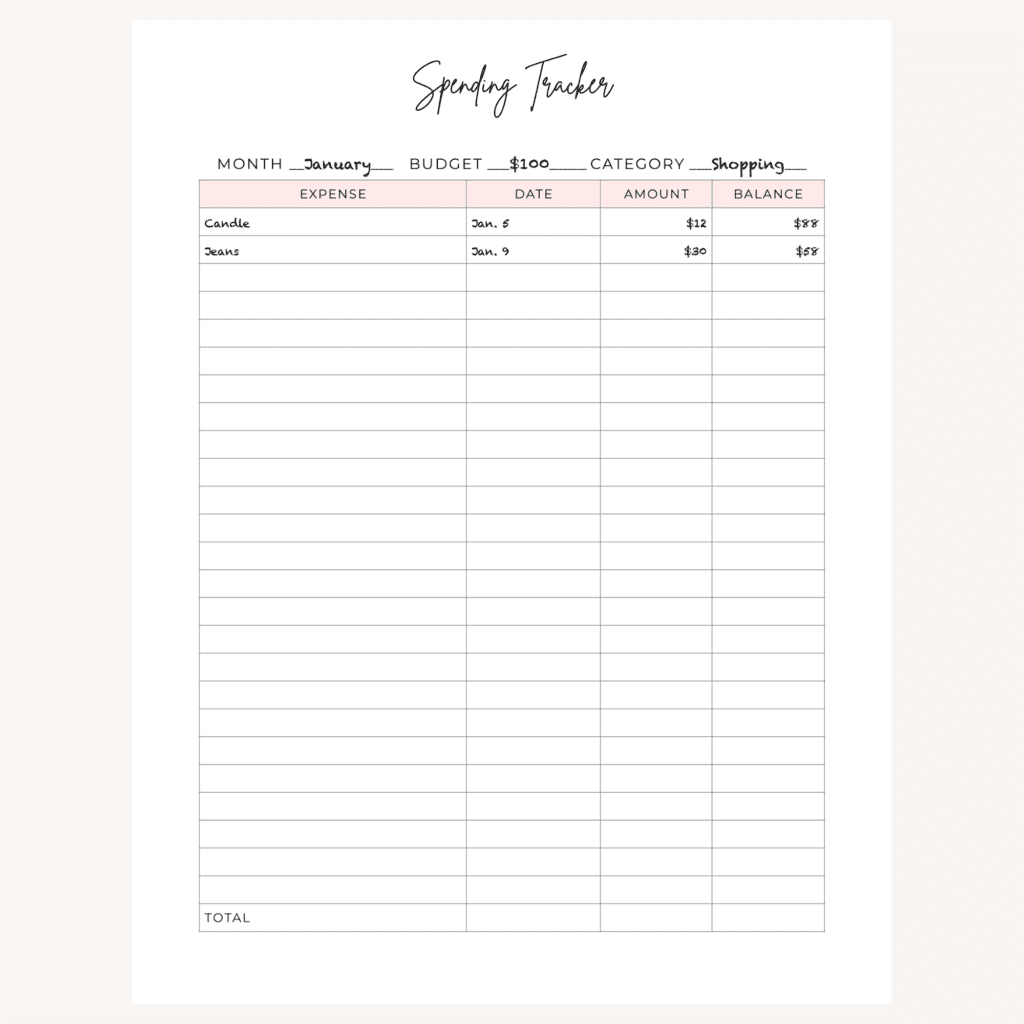

Spending Tracker

Want to know another reason reaching financial goals tin can be hard?

Over-spending. Specifically, mindless over-spending.

You think y'all only spend a little on eating out, merely in reality, your three times a calendar week $20 dinners is costing you over 200 bucks a month.

This Spending Tracker is like shooting fish in a barrel to customize for different spending categories, like eating out or groceries (pssst- the package also includes trackers for eating out, groceries, gas, and shopping!).

You can determine the spending category and your upkeep for it that month. So write down every fourth dimension you spend coin in this category, followed past how much is left now in your budget (the rest).

Subscriptions Tracker

If you don't want to be caught off-guard by an annual subscription that yous forgot about renewing, this ane's for y'all.

List each of your monthly, annual, and quarterly subscriptions (recall apps on your telephone, memberships, or subscription boxes), and the cost of each.

Here's the important part- detect out when each of these items renews, and record this renewal date. Then if you want to cancel it, yous can practise so on time.

Plus you get to see but how much money you spend a year on these things (you might decide to cancel a few).

Whew, thanks for sticking that one out! Equally you tin can see, each folio can assist you in then many ways.

And we only covered a handful- the Ultimate Budget Planner has over fifty pages!

As I mentioned, this is really something I put a lot of idea into, and I know y'all volition love yours!

If yous have whatsoever questions, know that I'chiliad always here for you lot- leave a annotate beneath, bulletin me on Etsy, or shoot me an email hither.

Happy Budgeting!

Source: https://prettyarrow.com/how-to-make-a-budget-binder-at-home/

0 Response to "How To Set Up A Budget Binder"

Post a Comment